“Enterprise Matters” Blog

ESG – Part 1 – The ESG Ecosystem By Simon Troup

Note: Part one and two of this post go into the weeds of the investing ecosystem with a focus on how ESG (Environmental, Social and Governance) investing has evolved, and sometimes failed in recent times. Use them as a launch into wider research to help your investing employability. It’s a lot to digest and may need a few reads to be fully ‘digested’. Good luck!

In this and a following post, we’ll dig into the current state of ESG Investing, with a focus on terminology, ESG investing evolution, marketing and the underlying objectives of ESG, Impact and Climate Transition strategies. If you are serious about a career in investing, the concepts in this listicle are foundational, especially if you have interest ESG and sustainable investing. They are particularly important when designing investment products and solutions that meet society’s needs. So, apologies in advance for the long list, but now is the time to ‘eat the frog’ of key concepts before getting into the detail in part two.

ESG (Environmental, Social and Governance) funds are relatively new, but even in the 10 years or so since they hit the mainstream their objectives and marketing strategies have changed materially. If you are looking for a career as an investor, ensure you understand this material to increase your credibility at interview. In part one we’ll set out some foundational concepts to frame three perspectives framed in part two.

- A Planetary Perspective – “Do ESG portfolios deliver positive planetary impact?“

- A Client Perspective – “Can I invest for good without paying a performance penalty?“

- A Portfolio Manager’s Perspective – “What is the future of responsible investing?”

Some Investing Terminology

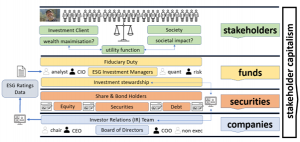

The institutional investing ecosystem of is a complex web of partners, counterparties and stakeholders; let’s get some terminology aligned before our deep dive in part two. Reflect on the terms that are product focused and associated with investor outcomes, and others are part of the wider ecosystem of stakeholder capitalism. The opening image maps out the list below; working from the bottom up…

Investor Relations “a division of a business, usually a public company, whose job it is to provide investors with an accurate account of company affairs. This helps private and institutional investors make informed decisions on whether to invest in the company.” – https://www.investopedia.com/terms/i/investorrelations.asp

- So What? – IR teams are employed by a listed company and so may be biased in the way they report “company affairs”. Research suggests larger companies with larger IR budgets may achieve better ESG ratings through more complete (polished?) data capture (an example of a data bias).

Investment Stewardship “stewardship is the use of influence by institutional investors to maximise overall long-term value including the value of common economic, social and environmental assets, on which returns and clients’ and beneficiaries’ interests depend.” – https://www.unpri.org/investment-tools/stewardship

- So What? – Investment stewardship teams (within a fund manager) work closely with investor relations (within the listed company) to influence the long-term purpose and operations of a company.

ESG Ratings “(MSCI) ratings are a comprehensive measure of a company’s long-term commitment to socially responsible investments (SRI) and environmental, social, and governance (ESG) investment standards.” – https://www.investopedia.com/msci-esg-ratings-5111990

- So What? ESG Ratings are dominated by a handful of companies (MSCI, Sustainalytics, Trucost), and can lead to investor dependency on ESG analytics and data science at the cost of independent research into specific company ESG issues and controversies.

ESG Investing “Environmental, social, and governance (ESG) investing refers to a set of standards for a company’s behaviour used by socially conscious investors to screen potential investments.” – https://www.investopedia.com/terms/e/environmental-social-and-governance-esg-criteria.asp

- So What? ESG investing focuses on screening out bad companies measured by E, S and G ratings. The exclusion approach may lead to higher financing costs for ‘unloved’ sectors such as energy, which in turn may be detrimental to our climate transition needs.

Impact Investing “Impact investing is an investment strategy that aims to generate specific beneficial social or environmental effects in addition to financial gains.” – https://www.investopedia.com/terms/i/impact-investing.asp

- So What? Impact investing actively directs capital to technology products, infrastructure projects and other capital-intensive activities that (in the mind of the manager) have a positive societal impact. Impact investing often occurs though private markets including venture capital.

Climate Transition Investing “Climate investing supports technologies or companies that are likely to become important as the world transitions away from fossil fuels and carbon-intensive industries.” – https://www.investopedia.com/articles/investing/051514/preparing-your-portfolio-climate-change.asp

- So What? Climate Transition funds allocate capital to companies and projects that advance climate targets and objectives, noting that these may include investing in ‘brown’ assets that would be excluded from screened ESG investments (such as coal).

Stakeholder Capitalism “Stakeholder capitalism is a system in which corporations are oriented to serve the interests of all their stakeholders. Among the key stakeholders are customers, suppliers, employees, shareholders, and local communities.” – https://www.investopedia.com/stakeholder-capitalism-4774323

- So What? – ESG investing is closely associated with Stakeholder Capitalism that recognises both economic and societal stakeholders. ESG managers allocate capital to maximise financial and societal benefits.

Some Controversy

One motivation for writing these posts was my experience building out the ESG ecosystem at BlackRock (the world’s largest asset manager). When I joined in 2017 BlackRock were investing heavily in ESG Data, tools and investment products, and had made a number of senior hires across the firm. One of those leaders was Tariq Fancy, a former private equity investor who had founded a social enterprise Rumie in the EdTech sector. Tariq has since left BlackRock and become a critic of ESG funds. So before digging into our investment perspectives, take a moment to reflect on his interview with Yahoo-Finance here > https://www.youtube.com/watch?v=vs1OuGhpvd0

![]()

Some Reflections

Tariq raises some important questions about ESG investing, marketing and societal impact. The challenges are centred on the fiduciary duty held by investment managers (to put clients first) and the investment motivation of investors (typically wealth maximisation), as defined below.

Fiduciary (“clients first”) > “A fiduciary is a person or organization that acts on behalf of another person or persons, putting their clients’ interests ahead of their own, with a duty to preserve good faith and trust.” – https://www.investopedia.com/ask/answers/042915/what-are-some-examples-fiduciary-duty.asp

- So What? – Responsible investment managers are often challenged when acting as a fiduciary of client funds. That fiduciary duty is typically defined in financial metrics (a wealth maximisation objective) even in an ESG fund.

Utility Function (“client motivation”) > “utility represents the satisfaction or pleasure that consumers receive for consuming a good or service.” – https://www.investopedia.com/ask/answers/072915/what-utility-function-and-how-it-calculated.asp

- So What? – It is difficult to define an ‘impact’ utility function such that it transparently drives ESG investment portfolios’ objectives. It is far easier to define financial objectives as a wealth maximisation utility in USD.

Another So What!

The TLDR (too long didn’t read) is that observing and measuring societal impact of investing is extremely difficult and investors are generally not ready to give up significant up-side (in financial terms) to be on the ‘good’ side of investment history. In other words, a wealth utility is (relatively) easy measure, impact is not. More about that in part two.

What Next?

As promised, this listicle frames a wider purpose of investing that ALL students pursuing and investing career should account for in applications and at interview. We’ll conclude with a call to action in preparation of interviewing for investment positions.

Investor Relations – Understand how companies raise capital in primary markets by issuing equity and debt. Furthermore, ensure you understand how investment managers and companies maintain a dialogue through the lifecycle of a security in the secondary markets.

Fiduciary Duty – Understand the challenges of balancing financial fiduciary duty to clients with wider societal impact.

Investor Utility – Understand that investor utility is critical for designing investment products; ask oneself do we (investors) want to hold ‘good’, ‘impactful’ or ‘financially appreciating’ companies?

Responsible Investing Strategies – Understand the differences between ESG investing (invest only in ‘good’ companies, exclude ‘bad’ companies), impact investing (targeting specific impact outcomes) and transition investing (unconstrained investing to advance a climate transition plan)

In part two I’ll add some colour to the challenges that Tariq Fancy raises for ESG investing, and detail why institutional investors are allocating more funds to ‘transition’ products that permit more flexibility for portfolio managers, with evidence from BlackRock’s marketing materials.