“Enterprise Matters” Blog ESG – Part 2 – ESG or Transition Investing? By Simon Troup

https://www.youtube.com/watch?v=vs1OuGhpvd0

![]()

In ESG part one I framed concepts necessary to assess the current and future state of ESG, Impact and transition investing. In part two, by leveraging three important perspectives, we’ll bust some myths about sustainable investing performance and impact, and challenge ourselves to imagine investment new and impactful products. The perspectives……

- A Planetary Perspective – “Do ESG portfolios deliver positive planetary impact?“

- A Client Perspective – “Can I invest for good without paying a performance penalty?“

- A Portfolio Manager’s Perspective – “What is the future of responsible investing?”

A reminder, these perspectives relate to interviews Tariq Fancy, former CIO of Sustainable Investing at BlackRock, has given since 2019. Since Tariq left BlackRock he’s constructively challenged institutional investors and I’d encourage students to follow him on LinkedIn for some great content. Let’s start with perspective number one, the planet….

A Planetary Perspective

Does ESG investing really impact the planet? This is a gnarly problem worthy of a much deeper discussion. However, there are some market mechanics that suggest ESG funds have limited potential to impact. ESG strategies may have limited impact for the follow reasons….

QUESTION >> How much planetary impact can secondary markets ESG funds have?

CONTEXT >> Institutional investors are asset allocators on behalf on their clients, for example the firms that manage our pensions or university endowments. They have a finite amount of capital to allocate across asset classes (equities, bonds, money markets etc), perhaps with different objectives (income, capital appreciation) or managers (BlackRock, Schroders etc). However the pool of assets is finite with the majority invested in liquid secondary market securities (equities and bonds).

SO WHAT >> Generally flows into liquid ESG funds are not directly financing companies, they are investing in existing securities. Furthermore funds often apply a screening approach, for example the https://www.blackrock.com/uk/individual/products/305419/ishares-msci-world-esg-screened-ucits-etf . Such ETF funds….

“….screen out exposure to: controversial and nuclear weapons; the production of tobacco or civilian firearms; revenue from thermal coal based power generation; the distribution, retail and supply of tobacco related products; the distribution of civilian firearms; fossil fuel extraction; the production or distribution of palm oil, or the extraction of arctic oil and gas; United Nations Global Compact violators; and companies involved in very severe controversies….”

ESG funds move investments from ‘bad’ to ‘good’ sectors, from ‘controversial’ companies to ‘safe’ ones, but they are not seeding new technologies and innovation directly. It’s more of an ‘impact hope’ than an ‘impact plan’!

INTERVIEW TAKE AWAY >> Secondary markets investing may have limited impact, in fact for screened funds it may lead to ‘stranded assets’ in divested sectors. Worse, it may incentivise companies to carve out dirty operations to murky private ownership to raise their ESG rating. Understand that impact investing that targets specific opportunities to advance our climate objectives may deliver greater impact than funds that just underweight ‘bad’ sectors (energy, tobacco etc).

A Client Perspective

Clients allocate capital to funds with an objective in mind, it could be income in retirement, capital growth for those far from retiring or capital preservation for high net worths looking to provide a legacy to family.

ESG investing promised to deliver a return maximising utility whilst investing in companies screened against Environmental, Social and Governance criteria (see the ETF above). In other words, “invest in ‘good’ companies without a performance drag”. Recent geo-political events have left these funds with underwhelming performance. And unfortunately, clients commitment to ESG principals are fragile when compared to their commitment to their maximising their wealth!!

QUESTION >> Why is there an outflow trend in ESG investments?

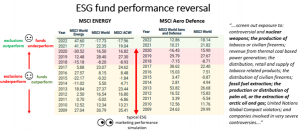

CONTEXT >> In the last 10 years, the ENERGY and AERO-DEFENCE sectors have (generally) underperformed the market providing a performance lift to ESG funds (they underweight these sectors). In recent years conflicts in Ukraine and the middle east have provided a boost for oil and defence stocks. It’s difficult for ESG funds to deliver outperformance relative to the market, whilst not holding energy or defence stocks. The tables below show how funds screening ENERGY and DECENCE sectors have had a challenging performance environement.

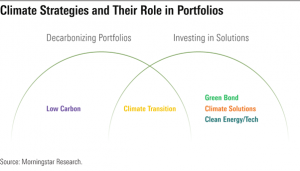

SO WHAT >> Delivering on the promise of holding exclusively ‘good’ sectors without a drag on returns is extremely challenging over the long term. As we’ll see, investment managers have pivoted their strategies towards ‘transition’ products that take an unconstrained approach to investing for climate action. Climate transition strategies typically permit investments in ALL sectors.

INTERVIEW TAKE AWAY >> At interview ensure you understand investors’ goals and objectives; that is to mostly to maximise financial returns. ESG fund raising is easy when underweight sectors underperform (and therefore funds outperform), as they did between 2010 and 2020. However, due to their fiduciary duty to their clients (us) wealth managers must redeem in the best interest of clients if those trends reverse and performance drags. This has led to ESG outflows.

A Portfolio Manager’s Perspective

Despite the headwinds described above, investors are still seeking high quality products that meet ESG objectives, however not at the expense of performance. And if there’s one thing the markets are good at its financial innovation!!

QUESTION >> How have fund managers pivoted given these impact and performance challenges?

CONTEXT >> Screened ESG funds effectively are asking active managers to enter a fight with one hand behind their back. Remember its hard enough to beat the markets, potentially impossible when a chunk of your universe is mandated as uninvestable. Investment managers have had to innovate to find ways to open out the investable universe, whilst still tethering their investments to a compelling climate impact narrative.

SO WHAT >> A solution to this challenge has been the loosening of investment constraints to include ALL sectors, with a focus on investing in the most impactful companies regardless of industry. Often described as investing in ‘brown assets’ this process involves for example identifying (for example) the energy companies that are constructively investing in the “brown to green transition”. The best way to describe such approaches is to quote Mark Wiedman, Head of Client Business at BlackRock (full blog here > https://www.linkedin.com/pulse/transition-investing-progress-blackrock-mark-wiedman-bgiee/ )

![]()

“Our transition investment platform includes $115 billion of client money across index, active, and private market strategies (as of November 2023). Here are some examples of what our investment teams are up to.

Decarbonization Partners – BlackRock entered the growth equity space in 2021 with the launch of Decarbonization Partners – a joint venture with https://www.linkedin.com/company/temasek-holdings/?originalSubdomain=sg

invests in transition-oriented growth companies ready to scale proven technologies. Fund I has completed six investments to date across batteries, carbon management, and alternative leathers – with over $1.3 billion raised so far.

Brown to Green Materials Fund – I recently https://www.linkedin.com/posts/mark-wiedman-7a9141200_blackrock-the-brown-to-green-transition-activity-7127401563291021313-1QV_?utm_source=share&utm_medium=member_desktop about how the transition depends on the raw materials that undergird it, like copper. Decarbonizing these activities is the “brown to green” transition. Our dedicated investment team, led by https://www.linkedin.com/in/olivia-markham-485824136/ and https://www.linkedin.com/in/evy-h-5399b4b5/ , screen the metals and materials industries to find the firms best positioned to decarbonize their operations and/or attract investment related to the transition. For more, see BlackRock’s recent brown to green paper: https://content.blackrock.com/i/od4FeO55PLUSSIGNvPLUSSIGN8E84ojNmAl___Ej7elkvkgDA1___S5RuVSxARY9Z___ypmZHVMoTqy60WgnyWfUfsC9K8bm7duDwEJLN599aqOG6jGOxhhf28FjmUMVUWXCc0ElBWvAHPLUSSIGNVhGDzK?cid=organic-social:::mark+wiedman::::na&linkId=100000225281944 .

New Zealand government partnership – New Zealand recently set one of the most ambitious decarbonization targets in the world: 100% renewable energy-powered electricity by 2030. New Zealand needs lots more capital for more wind, solar and geothermal plants – and more transmission and storage. Also earlier this year, the New Zealand government announced its partnering with BlackRock to launch a New Zealand-focused strategy that will target a raise of NZ$2 billion for investment in the country’s climate infrastructure. It’s the largest single-country low-carbon investment initiative we’ve created to date. Earlier this year, I visited the kinds of infrastructure we will be funding in Auckland at https://www.linkedin.com/company/solarzeronz/ – check out https://www.linkedin.com/posts/blackrock_outofoffice-activity-7070459595793539072-Oipr?utm_source=share&utm_medium=member_desktop .”

INTERVIEW TAKE AWAY >> ESG, Impact and Transition investing is innovating rapidly, make sure you understand the impact strategy of venture funding (BlackRock’s Decarbonization Partners), the impact strategy for brown assets (BlackRock’s Brown to Green Materials Fund) and for infrastructure, often through large private markets fund raising (New Zealand partnership). All of these strategies have agency to invest in the most impactful opportunities.

IMPORTANT >> One could accuse BlackRock cynical product innovation as they build a moat around their sustainable investing business. Regardless of your view, it is certainly appropriate to look across our climate transition challenges and objectives, as identified at COP, and allocate capital to catalyse change via a thoughtful and deliberate process.

What Next

If you are still reading, kudos for sticking with it, it’s a long one! There are a number of take aways already identified; firstly, a call to action is to follow folks like Tariq Fancy and Mark Weidman on LinkedIn to keep on top of both sides of the ESG debate. Secondly to commit to keeping track of innovations in this fast-moving investment category through the media and from thought leaders (companies and individuals). For example deep dive the pdfs at the end of Mark’s post (link here https://www.linkedin.com/pulse/transition-investing-progress-blackrock-mark-wiedman-bgiee/ ). Good luck!